| Preliminary Proxy Statement | ||||||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||||

| x | Definitive Proxy Statement | |||||

| Definitive Additional Materials | ||||||

| Soliciting Material | ||||||

Specified In Its Charter)

Registrant)

| x | ||||||||

| No fee required. | ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| Fee paid previously with preliminary materials. | ||||||||

| ||||||

| ||||||

| ||||||

| ||||||

8, 2024

You areShareholders:

Central Daylight Time. The Annual Meeting will be conducted solely online via live webcast. You will be able to listen to the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the Annual Meeting. You may access the Annual Meeting by visiting www.meetnow.global/MYW7T2Y on the meeting date at the time described in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. Please check in early to ensure that you can access the Annual Meeting on your computer or other electronic device. You will find information regarding the matters expected to be addressed at the meeting areAnnual Meeting described in detail in the accompanying Notice of Annual Meeting of StockholdersShareholders and Proxy Statement.

There is no physical location for the Annual Meeting.

Wefor being a shareholder and we look forward to seeing you at the meeting.

Stephen M. King

DAVE & BUSTER’S ENTERTAINMENT, INC.

2481 Mañana Drive

Dallas, TX 75220

| DAVE & BUSTER’S ENTERTAINMENT, INC. 1221 S. Belt Line Road, #500 Coppell, Texas 75019 | ||||

SHAREHOLDERS

Shareholders:

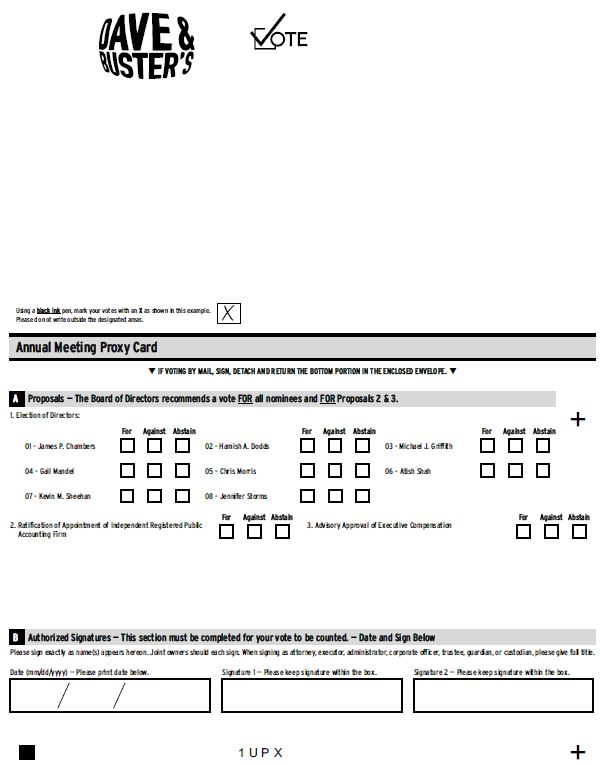

| When: | 8:30 a.m. Central Daylight Time Thursday, June 20, 2024 | Items of Business: •To elect the | ||||||||||||

•To ratify the appointment of KPMG LLP as our independent registered public accounting firm for |

| fiscal 2024. •To cast an advisory vote on executive compensation. |

•To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. | ||||||||

| Where: | The Annual Meeting will be held virtually. | |||||||

| Webpage: | www.meetnow.global/MYW7T2Y | |||||||

| Who Can Vote: | ||||||||

| Only shareholders of record at the close of business on April 25, 2024, are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof. | ||||||||

Jay L. Tobin

Senior

General Counsel

Dallas, Texas

May 4, 2016

The Company’s Proxy Statement and Annual Report on Form 10-K are available at http://edocumentview.com/play.

20, 2024.

| The Company’s Proxy Statement and Annual Report on Form 10-K are available at http://edocumentview.com/play. | ||

Shareholders

| Page | ||||||

| ||||||

| Page | ||||||

DAVE & BUSTER’S ENTERTAINMENT, INC.

2481 Mañana Drive, Dallas, Texas 75220

PROXY STATEMENT

May 4, 2016

29, 2023: Main Event. implement in Fiscal 2024.Table of ContentsTHE MEETINGThe accompanying proxy is solicited2024 Proxy Statement SummaryThis summary highlights selected information on behalf of the Board of Directors (the “Board of Directors” or the “Board”) of Dave &and Buster’s Entertainment, Inc., a Delaware corporation (sometimes referred to herein as “we,” “us,”“we”, “us”, “our” or the “Company”), for use at that is provided by our Board of Directors (the “Board of Directors” or the 2016 Annual Meeting“Board”) in more detail throughout the Proxy Statement. This summary does not contain all of Stockholders (the “Annual Meeting”) to be held at the Westin O’Hare Hotel, 6100 N. River Road, Rosemont, IL 60018, on June 16, 2016, at 8:30 a.m. local time. We posted thisinformation you should consider before voting, and you should read the entire Proxy Statement and the accompanying proxy on or about May 4, 2016, to our website at www.daveandbusters.com, and mailed notice on or about May 4, 2016 to all stockholdersbefore casting your vote.Annual Meeting Information Date: ThursdayJune 20, 2024VotingOnly shareholders as of the Record Date (April 25, 2024) are entitled to vote.Participating Online during the Annual MeetingIf you are a registered shareholder (the shares are held in your name), you register by following the instructions set forth at www.meetnow.global/MYW7T2Y or in the FAQs section of this Proxy Statement (page 51).If you are a beneficial shareholder (the shares are held in the name of your bank, brokerage firm or other nominee), you will need to obtain a “legal proxy” from the registered shareholder (your bank, brokerage firm or other nominee) to register to vote at the annual meeting and follow the instructions set forth in the FAQs section of this Proxy Statement (page 51).Time: 8:30 a.m.Central Daylight TimePlace: The Annual Meeting will be held virtually. Webpage: www.meetnow.global/MYW7T2Y Record Date: April 25, 2024  Vote via InternetFollow the instructions on yourNotice or Proxy Card

Vote via InternetFollow the instructions on yourNotice or Proxy Card Vote via PhoneCall the number onyour Notice or Proxy Card

Vote via PhoneCall the number onyour Notice or Proxy Card Vote viaMailFollow theinstructionson your Noticeor Proxy Card

Vote viaMailFollow theinstructionson your Noticeor Proxy Card Vote Onlineduring theAnnual MeetingRegister toparticipate in theAnnual Meetingvirtually and voteonline

Vote Onlineduring theAnnual MeetingRegister toparticipate in theAnnual Meetingvirtually and voteonlineDave & Buster’s Entertainment, Inc 1 Shareholders Action Proposals Description Board Voting

RecommendationVotes

RequiredPage

Reference1 Election of Directors FOR each

nomineeMajority 2 Ratification of Appointment of

Independent Registered Public Accounting FirmFOR Majority 3 Advisory Vote on Executive Compensation FOR Majority Information about the Board of Directors at 2023 Fiscal Year End: Independence, Committees and Meetings Director Board of

DirectorsAudit

CommitteeCompensation

CommitteeNominating

and Corporate

Governance

CommitteeFinance

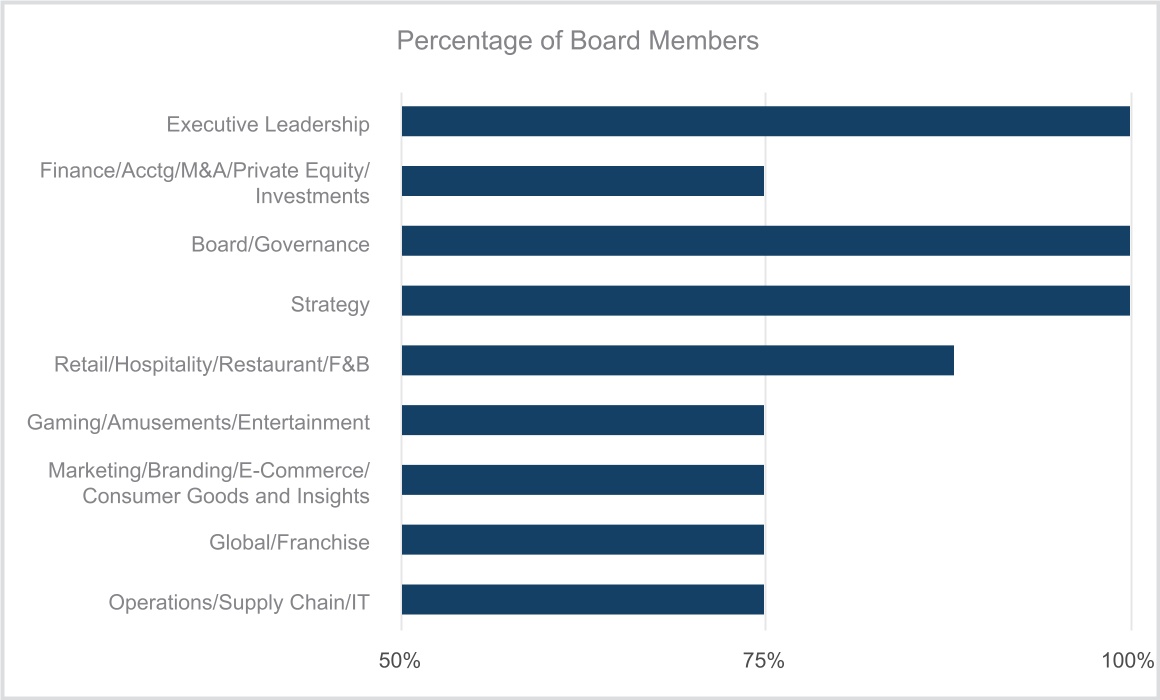

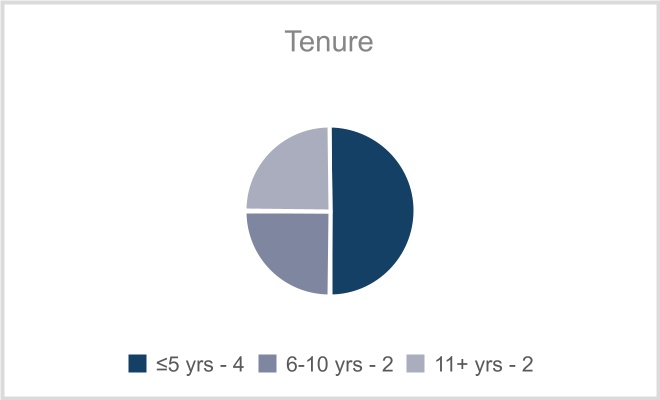

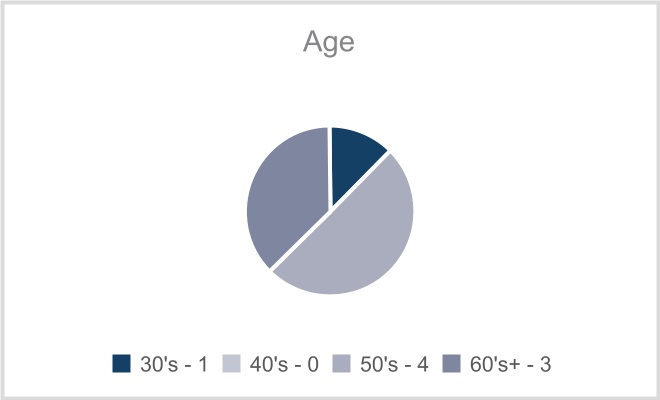

CommitteeJames P. Chambers I C M Hamish A. Dodds I M C Michael J. Griffith I M M Gail Mandel I M M Chris Morris (1)CEO Atish Shah I C M Kevin M. Sheehan (2)COB M Jennifer Storms I M C Number of Meetings in Fiscal 2023 6 6 3 5 8 I – Independent Director LID – Lead Independent Director CEO – Chief Executive Officer COB – Chair of the Board C – Committee Chair M – Committee Member (1) – As a non-independent member of the Board, Mr. Morris does not serve on any committees. (2) – Mr. Sheehan is our independent Chair of the Board. Dave & Buster’s Entertainment, Inc 2 Board Skills and Core Competencies of Current Board Members: Our Board is comprised of directors who have a variety of skills and core competencies as noted in the chart below: Our Board is also diverse in age, tenure, gender and ethnicity as noted in the charts and matrix below:

Our Board is also diverse in age, tenure, gender and ethnicity as noted in the charts and matrix below:

Dave & Buster’s Entertainment, Inc 3 Board Diversity Matrix (As of April 25, 2024) Board Size: Total # of Directors 8 Gender: Male Female Non-Binary Undisclosed # based on Gender Identity 6 2 – – # of Directors who identify in any of the categories below: African American or Black 1 – – – Alaskan Native or American Indian – – – – Asian 1 – – – Hispanic or Latinx – – – – Native Hawaiian or Pacific Islander – – – – White 4 2 – – Two or More Races or Ethnicities – – – – LGBTQ+ 1 Undisclosed – Corporate Governance Highlights: We are committed to maintaining strong corporate governance practices that promote and protect the long-term interests of our shareholders. Our practices are designed to provide effective oversight and management of our Company as well as meet our regulatory and NASDAQ requirements, including the following:üIndependent Chair of the BoardüStrong Director Attendance RecordüAudit, Compensation, and Nominating and Corporate Governance Committees comprised of only Independent DirectorsüShare Ownership Requirements for Directors and Top OfficersüRegular Executive Sessions of Independent DirectorsüDirector Overboarding PolicyüDiverse BoardüMandatory Director Retirement AgeüCommitment to Board RefreshmentüAnnual Board and Committee EvaluationsüAnnual Director ElectionsüContinued Engagement with Our ShareholdersüMajority Voting in Uncontested Director ElectionsüNo Shareholder Rights PlanüCommitment to Director EducationDave & Buster’s Entertainment, Inc 4 Fiscal 2023 Business Performance Highlights: •Revenue of $2.2 billion increased 12.3% from fiscal 2022.•Pro forma combined comparable store sales (including Main Event branded stores) decreased 6.2% compared with fiscal 2022 and increased 8.0% compared with the same period in 2019.•Net income totaled $126.9 million, or $2.88 per diluted share, compared with net income of $137.1 million, or $2.79 per diluted share in fiscal 2022. Adjusted net income totaled $156.9 million, or $3.57 per diluted share, compared with adjusted net income of $159.1 million, or $3.23 per diluted share in fiscal 2022.•Adjusted EBITDA of $555.6 million, or 25.2% of revenue, increased 15.7% compared to the same period in 2022.Fiscal 2023 Executive Compensation Highlights and Key Practices: •We continued to receive strong support from shareholders for our compensation practices with a 91% approval vote at the 2023 Annual Shareholder Meeting.Voting Rights, Quorum•In designing our fiscal 2023 compensation, we maintained our focus on our three core values for compensation: pay for performance, market-competitive pay and Required VoteOnly holderssustained shareholder value creation.Fiscal 2023 Corporate Social Responsibility Highlights: •We remain strongly committed to improving diversity, equity and inclusion in our culture. We:◦enhanced our commitment to women in leadership through greater participation in membership in, and activity with, Women's Foodservice Forum (WFF).◦emphasized our commitment to diversity and belonging throughout the year in internal and external communications, including social media.•We remain committed to thoughtful environmental sustainability, social and governance (ESG) practices. To this end, we:◦published our first corporate responsibility report including our alignment to Sustainability Accounting Standards Board (SASB) standards for restaurants and entertainment companies in April of record2023.◦completed an initial Operational Footprint Analysis (Scope 1 & 2 GHG emissions) to provide a base year measurement for future reporting.◦published our 2024 update to our corporate responsibility report in April 2024.Dave & Buster’s Entertainment, Inc 5 PROPOSAL NO. 1ELECTION OF DIRECTORSYour proxy will be used to voteFORthe election of all of the nominees named below unless you abstain from or vote against the nominees when you send in your proxy. TheFollowing the election of directors, the Company’s Board of Directors is presentlywill be comprised of eleveneight (8) members. J. Taylor Crandall and Tyler J. Wolfram have notified us that they will not stand for re-election to the Board of Directors. Each of the nominees for election to the Board of Directors is currently a director of the Company. If elected at the Annual Meeting, each of the nominees will serve for one year or until his or her successor is duly elected and qualified, or until such director’s earlier death, resignation or removal. If any of the nominees is unable or unwilling to be a candidate for election by the time of the Annual Meeting (a contingency which the Board does not expect to occur), the stockholdersshareholders may vote for a substitute nominee chosen by the present Board to fill a vacancy. In the alternative, the stockholdersshareholders may vote for just the remaining nominees leaving a vacancy that may be filled at a later date by the Board. Alternatively, the Board may reduce the sizeits size.We are furnishing below certain biographical information about each of the Board.The nameseight (8) nominees for director. Also included is a description of the nominees for election as directors at the Annual Meeting, including their ages asexperience, qualifications, attributes and skills of May 4, 2016, are included below. Nominee Age Position Year Elected Director Michael J. Griffith(1)(2) 59 Director 2011 Jonathan S. Halkyard(1)(2)(7) 51 Director 2011 David A. Jones(4)(5) 66 Director 2010 Stephen M. King 58 Chief Executive Officer and Director 2006 Alan J. Lacy(1)(3) 62 Chairman and Lead Independent Director 2010 Kevin M. Mailender(3)(4) 38 Director 2010 Patricia H. Mueller(1) 53 Director 2015 Kevin M. Sheehan(4)(6) 62 Director 2011 Jennifer Storms 44 Director 2016 (1) Membereach nominee.James P. Chambers DIRECTOR SINCE:2020AGE:38COMMITTEES:Compensation & FinanceDIRECTOR STATUS:INDEPENDENTCURRENT POSITION:–Co-Founder and Partner of Hill Path Capital, LP, a private investment firm investing in the equity and debt of public and private companies since 2016.Leadership, Strategy, Investments, Leisure & Hospitality, Entertainment, Finance and GovernancePRIOR BUSINESS EXPERIENCE:–Apollo Global Management, Inc. a global alternative investment management firm:•Principal (2011-2016)Leadership, Strategy, Leisure & Hospitality, Entertainment, Finance and Governance–Goldman Sachs & Co., Inc, a multinational investment bank and financial services company:•Analyst, Consumer Retail Group, Investment Banking Division (2009-2011)Leadership, Strategy, Retail, Investment, Finance, Food & BeveragePUBLIC COMPANY BOARDS:–Current: Dave & Buster’s Entertainment, Inc.United Parks & Resorts, Inc. OTHER COMPANY BOARDS:–Prior: CEC EntertainmentGreat Wolf Resorts, Inc. Principal Maritime Tankers Corp. Principal Chemical Carriers, LLC EDUCATION:–B.A. Political Science and Certificate in Markets and Management, Duke UniversityDave & Buster’s Entertainment, Inc 6 (4)Hamish A. Dodds DIRECTOR SINCE: 2017AGE: 67COMMITTEES: Audit & FinanceDIRECTOR STATUS:INDEPENDENTRECENT POSITION:–President and Chief Executive Officer of Hard Rock International, an owner, operator, and franchisor of restaurants, hotels, casinos, and live music venues in over seventy countries, from 2004-February 2017.Leadership, Strategy, Operations, Finance, Global, Franchise, Entertainment, Gaming, Food & BeveragePRIOR BUSINESS EXPERIENCE:–cbc (The Central American Bottling Corporation) (also known as CabCorp), a multi-Latin beverage company in more than 33 countries with strategic partners PepsiCo, Ambev and Beliv:•Chief Executive Officer (2002-2003)•Non-executive Director (2003-2010)Leadership, Strategy, Board Governance, Global, Distribution, Food & Beverage– PepsiCo, Inc., a multinational food, snack and beverage corporation:•Various management and financial positions including Division President and General Manager for beverage operations across Latin America, Europe and Middle East/North Africa (1989-2002)Accounting, Finance, Food & Beverage, Operations, Global–The Burton Group (now Arcadia Group) (an UK multinational retailing company) and Overseas Containers, Ltd. (an UK container shipping company):•Multiple management and financial positions (1982-1989)Accounting, Finance, Consumer Goods, RetailPUBLIC COMPANY BOARDS:– Current: Dave & Buster’s Entertainment, Inc.–Past 5 years: Pier 1 Imports, Inc. (2010-2020)OTHER POSITIONS/MEMBERSHIPS:–Fellow Member, Chartered Management AccountantsEDUCATION:–B.A. Business Studies, Robert Gordon University, ScotlandACCOLADES:–Honorary Doctorate, Business Administration, Robert Gordon University (2011)Michael J. Griffith DIRECTOR SINCE: 2011AGE: 67COMMITTEES: Compensation & Nominating andCorporate GovernanceDIRECTOR STATUS: INDEPENDENTPRIOR BUSINESS EXPERIENCE:–Activision Blizzard, Inc., a worldwide online, personal computer, console, handheld, and mobile game publisher:•Vice Chair (March 2010-August 2016)Leadership, Strategy, Board/Governance–Activision Publishing, Inc. (prior to merger with Blizzard Entertainment, Inc.), one of the world’s largest third-party video game publishers:•President and Chief Executive Officer (June 2005-March 2010)Leadership, Strategy, Finance, CommitteeAmusements/Gaming, Operations, Entertainment–The Procter & Gamble Company, a multinational consumer goods corporation:•Various executive positions, including President of the Global Beverage Division, Vice President and General Manager of Coffee Products, and Vice President and General Manager of Fabric & Home Care—Japan and Korea and Fabric & Home Care Strategic Planning—Asia (1981-2005)Leadership, Strategy, Global, Consumer Goods, Consumer Insights/MarketingPUBLIC COMPANY BOARDS:–Current: Dave & Buster’s Entertainment, Inc.Central Garden & Pet Company EDUCATION:–B.A. Mathematics, Computational Math, and Economics, Albion College, MI–M.B.A. Finance and Strategic Planning, University of Michigan(5) ChairDave & Buster’s Entertainment, Inc 7 (7)Gail Mandel DIRECTOR SINCE: 2022AGE: 55COMMITTEES: Audit & Nominating and CorporateGovernanceDIRECTOR STATUS: INDEPENDENTCURRENT POSITIONS:–Managing Director of Focused Point Ventures, LLC, a business advisory and consulting services organization since 2019.Leadership, Strategy, Investments, and Finance–Chair/Executive Chair of the Board of PureStar, a provider of laundry services and linen management to the hospitality industry since March 2020 and board member since August 2019.Leadership, Strategy, Finance, CommitteeMichael J. Griffith has served as Vice Chairman of Activision Blizzard, Inc., a worldwide online, personal computer, console, handheld, and mobile game publisher since March 2010. Previously, Mr. Griffith served as President and Chief Executive Officer of Activision Publishing, Inc., (“Activision”), prior to its merging with Blizzard Entertainment, Inc., from June 2005 to March 2010. Prior to joining Activision, Mr. Griffith served in a number of executive level positions at The Procter & Gamble Company from 1981 to 2005, including President of the Global Beverage Divisionfrom 2002 to 2005, Vice President and General Manager of Coffee Products from 1999 to 2002, and Vice President and General Manager of Fabric & Home Care—Japan and Korea and Fabric & Home Care Strategic Planning—Asia from 1997 to 1999. Mr. Griffith has served on our Board of Directors since October 2011. Mr. Griffith brings substantial industry, financial and leadership experience to our Board of Directors.Jonathan S. Halkyard has served as Chief Financial Officer of Extended Stay America Inc., the largest owner/operator of company branded hotels in North America, since January 2015. From September 2013 to January 2015, Mr. Halkyard served as Chief Operating Officer of Extended Stay America. From July 2012 to September 2013, Mr. Halkyard served as Executive Vice President and Chief Financial Officer of NV Energy, Inc., a holding company providing energy services and products in Nevada, and its wholly owned utility subsidiaries, Nevada Power Company and Sierra Pacific Power Company. Mr. Halkyard served as Executive Vice President of Caesars Entertainment Corporation (formerly known as Harrah’s Entertainment, Inc.), one of the largest casino entertainment providers in the world (“Caesars”), from July 2005 until May 2012, and Chief Financial Officer from August 2006 until May 2012. Previously, Mr. Halkyard served Caesars as Treasurer from November 2003 through July 2010, Vice President from November 2002 to July 2005, Assistant General Manager-Harrah’s Las Vegas from May 2002 until November 2002 and Vice President and Assistant General Manager-Harrah’s Lake Tahoe from September 2001 to May 2002. Mr. Halkyard has served on our Board of Directors since October 2011 and serves as Chair of our Finance Committee. Mr. Halkyard brings substantial industry, financial and leadership experience to our Board of Directors.David A. Jones serves as a Senior Advisor to Oak Hill Capital Partners III, L.P. and Oak Hill Capital Management Partners III, L.P. (collectively, the “Oak Hill Funds”) and other private equity funds managed by Oak Hill Capital Management, LLC (“Oak Hill”), and has been providing consulting services to Oak Hills’s private equity funds and various portfolio companies since 2008. He also currently serves as Executive Chairman of Imagine! Print Solutions (a differentiated provider of printed in-store marketing solutions), a director of Pentair, Ltd. (a diversified company manufacturing valves, fittings and water system, thermal management, and equipment protection products) and Earth Fare, Inc. (a chain of organic and natural food markets), and is a trustee emeritus of Union College. From 2005 until 2007, Mr. Jones was the Chairman and Global Chief Executive Officer of Spectrum Brands, Inc., a $4.3 billion publicly traded consumer products company with operations in over 120 countries worldwide and whose brand names include Rayovac, Varta, Remington, Cutter, Tetra and over fifty other major consumer brands. From 1996 to 2005, Mr. Jones was the Chairman and Chief Executive Officer of Rayovac Corporation (the predecessor to Spectrum Brands), a $1.4 billion publicly traded global consumer products company with major product offerings in batteries, lighting, shaving/grooming, personal care, lawn and garden, household insecticide and pet supply product categories. After Mr. Jones was no longer an executive officer of Spectrum Brands, it filed a voluntary petition for reorganization under Chapter 11 of the United States Bankruptcy Code in March 2009 and exited from bankruptcy proceedings in August 2009. In aggregate, Mr. Jones has over 35 years of experience in senior leadership roles at several leading public and private global consumer products companies. Mr. Jones has served on our Board of Directors since June 2010 and serves as Chair of our Compensation Committee. He brings substantial industry, financial and leadership experience to our Board of Directors.Stephen M. King has served as the Chief Executive Officer and Director of the Company or its subsidiaries since September 2006. From March 2006 until September 2006, Mr. King served as our Senior Vice President and Chief Financial Officer. From 1984 to 2006, he served in various capacities for Carlson Restaurants Worldwide Inc., a company that owns and operates casual dining restaurantsworldwide, including Chief Financial Officer, Chief Administrative Officer, Chief Operating Officer and, most recently, as President and Chief Operating Officer of International. Mr. King brings substantial industry, financial and leadership experience to our Board of Directors.Alan J. Lacy serves as a director of Bristol-Myers Squibb Company (a global biopharmaceutical company). Mr. Lacy is also currently Trustee of Fidelity Funds (a provider of financial management and advisory services). Previously, he served as Senior Advisor to Oak Hill’s private equity funds from 2007-2014. In addition, he was Vice Chairman and Chief Executive Officer of Sears Holdings Corporation, a large broad line retailer, and Chairman and Chief Executive Officer of Sears Roebuck and Co. (“Sears”), a large retail company. Prior to that, Mr. Lacy was employed in a number of executive level positions at major retail and consumer products companies, including Sears, Kraft, Philip Morris and Minnetonka Corporation. Mr. Lacy is a Trustee of the California Chapter of The Nature Conservancy and a Director at The Center for Advanced Study in The Behaviorial Sciences at Stanford University. Mr. Lacy has served on our Board of Directors since June 2010, serves as Lead Independent Director and has served as Chairman since September 2014. He brings substantial industry, financial and leadership experience to our Board of Directors.Kevin M. Mailender is a Partner of Oak Hill and has been with the firm since 2002. Mr. Mailender is responsible for originating, structuring and managing investments in the Consumer, Retail and Distribution sectors. He currently serves as a director of Imagine! Print Solutions (a differentiated provider of printed in-store marketing solutions), The Hillman Companies, Inc. (a distributor of fasteners, key duplication systems, engraved tags and other hardware items), Earth Fare, Inc. (a chain of organic and natural food markets) and Berlin Packaging (a privately-held, full-service strategic supplier of rigid packaging products). Mr. Mailender has served on our Board of Directors since June 2010 and brings substantial financial, investment and business experience to our Board of Directors.Patricia H. Mueller has served as Senior Vice President and Chief Marketing Officer of The Home Depot, Inc. (the world’s largest home improvement retailer) since February 2011. Ms. Mueller served as Vice President, Advertising of The Home Depot, Inc. from September 2009 to February 2011. Ms. Mueller also serves on the board of The Home Depot Foundation. Ms. Mueller previously served as Senior Vice President of Marketing and Advertising of The Sports Authority, Inc. from September 2006 to August 2009, Vice President of Advertising of American Signature, Inc. from September 2004 to August 2006 and held senior roles with Value Vision, Inc./ShopNBC from 1999 to 2004, including Senior Vice President TV Sales & Promotions, Senior Vice President Strategic Development and Senior Vice President Marketing & Programming. Ms. Mueller has served on our Board of Directors since April 2015 and brings substantial marketing, advertising and retail experience to our Board of Directors.Kevin M. Sheehan serves as the John J. Phelan, Jr. Distinguished Professor in the Robert B. Willumstad School of Business at Adelphi University. Mr. Sheehan served as President of NCL Corporation Ltd., a leading global cruise line operator (“Norwegian”), from August 2010 through January 2015 (and previously from August 2008 through March 2009) and Chief Executive Officer of Norwegian from November 2008 through January 2015. Mr. Sheehan also served as Chief Financial Officer of Norwegian from November 2007 until September 2010. Before joining Norwegian, Mr. Sheehan spent two and one-half years consulting to private equity firms including Cerberus Capital Management LP (2006-2007) and Clayton Dubilier & Rice (2005-2006). From August 2005 to January 2008, Mr. Sheehan served on the faculty of Adelphi University as Distinguished Visiting Professor—Accounting, Finance and Economics. Prior to that, Mr. Sheehan served a nine-year career with Cendant Corporation, most recently serving as Chairman and Chief Executive Officer of itsVehicle Services Division (including global responsibility for Avis Rent A Car, Budget Rent A Car, Budget Truck, PHH Fleet Management and Wright Express). Mr. Sheehan serves on the Board of Directors, as Chairman of the Audit Committee, and as a member of the Compensation Committee of New Media Investment Group Inc. (one of the largest publishers of locally based print and online media in the United States) and serves on the Board of Directors of Bob Evans Farms, Inc. (an owner and operator of full-service restaurants and a leading producer and distributor of refrigerated and frozen foods). Mr. Sheehan has served on our Board of Directors since October 2011 and is the Chair of our Audit Committee. Mr. Sheehan brings substantial investment, financial and business experience to our Board of Directors.Jennifer Storms has served as Chief Marketing Officer for NBC Sports Group, a division of NBCUniversal, one of the world’s leading media and entertainment companies in the development, production, and marketing of entertainment, news and information, since October 2015. Ms. Storms served in various capacities, most recently as Senior Vice President, Global Sports Marketing, of PepsiCo, Inc. from 2011 to 2015. Prior to that, Ms. Storms served as Senior Vice President, Sports Marketing of PepsiCo-owned Gatorade from 2009 to 2011 and served in various marketing and programming leadership positions at Turner Broadcasting System/Turner Sports, most recently as Senior Vice President, Sports Programming and Marketing, from 1995 to 2009. Ms. Storms has served on our Board of Directors since April 2016 and brings substantial marketing, advertising, and strategic experience to our Board of Directors.Hospitality, Governance PRIOR BUSINESS EXPERIENCE:–Wyndham Worldwide:•President and Chief Executive Officer of Wyndham Destination Network (f/k/a Wyndham Exchange & Rentals), an operating division of Wyndham Worldwide and a provider of professionally managed, unique vacation accommodations (November 2014-June 2018)•Chief Operating Officer and Chief Financial Officer of Wyndham Exchange & Rentals (March-November 2014)•Executive Vice President, Chief Financial Officer of Wyndham Exchange & Rentals (2010-2014)•Senior Vice President, Financial Planning & Analysis of Wyndham Worldwide (2006-2010)Leadership, Strategy, Finance, Investments, Operations, Global, Technology–Cendant Corporation, a provider of business and consumer services primarily in real estate and travel industries:•Various executive positions, including Senior Vice President, Chief Financial Officer and Controller of Hospitality Services Division (1993-2006)•Various positions of HFS (formerly Hospitality Franchise Systems, Inc. and predecessor to Cendant Corporation (1993-1997)Leadership, Strategy, Finance, Accounting, Hospitality, FranchisePUBLIC COMPANY BOARDS:–Current: Dave & Buster’s Entertainment, Inc.Sabre Corporation OTHER POSITIONS/MEMBERSHIPS:–Certified Public Accountant (State of New York, Inactive)EDUCATION:– B.B.A., Public Accounting, summa cum laude from Pace University–Global Leaders Program, The Wharton School, University of PennsylvaniaACCOLADES:–Named one of the 30 Most Influential Women in Hospitality (2017)– Recipient of Highest Leaf Award from Women’s Venture Fund (2016)Dave & Buster’s Entertainment, Inc 8 Chris Morris DIRECTOR SINCE: 2022AGE: 53COMMITTEES: NoneDIRECTOR STATUS: ManagementCURRENT POSITIONS:–Chief Executive Officer for Dave & Buster's Entertainment, Inc., since June 2022.Leadership, Strategy, Board Governance, Finance, Operations, Food & Beverage, Amusements/Gaming, Marketing, Consumer Insights, GlobalPRIOR BUSINESS EXPERIENCE:–Main Event Entertainment, Inc., a leading provider of family-focused location-based entertainment and dining:•President and Chief Executive Officer (March 2018-June 2022)Leadership, Strategy, Finance, Investments, Operations, Global, Food & Beverage,Amusements/Gaming, Marketing, Consumer Insights–California Pizza Kitchen, a casual dining restaurant chain specializing in California style pizza:•President (2014-2018)Leadership, Strategy, Finance, Investments, Operations, Global, Food & Beverage, Marketing, Consumer Insights–On the Border Mexican Grill & Cantina, a casual dining restaurant chain specializing in Tex-Mex style food:•Chief Financial Officer (2010-2014)Leadership, Strategy, Finance, Investments, Global, Food & Beverage, Marketing, Consumer Insights–CEC Entertainment, Inc., the owner and operator of the Chuck E. Cheese family entertainment and dining brand:•Chief Financial Officer (2004-2010)Leadership, Strategy, Finance, Investments, Operations, Global–NPC International, one of the largest franchisees of Pizza Hut and Wendy's:•Various positions including Senior Director of Finance (1999-2004)Leadership, Strategy, Finance, Investments, Operations, Global–Applebee's International, Inc., a casual dining restaurant company:•Various finance positions (1996-1999)Leadership, Strategy, Finance, Hospitality, FranchisePUBLIC COMPANY BOARDS:–Current: Dave & Buster’s Entertainment, Inc.EDUCATION:– B.S., Accounting, Missouri State University–M.B.A. University of KansasDave & Buster’s Entertainment, Inc 9 Atish Shah DIRECTOR SINCE: 2021AGE: 51COMMITTEES: Audit & Nominating and Corporate GovernanceDIRECTOR STATUS: INDEPENDENTCURRENT POSITION:–Executive Vice President, Chief Financial Officer and Treasurer of Xenia Hotels & Resorts, Inc., a NYSE-listed REIT investing in luxury and upper upscale hotels and resorts since April 2016.Leadership, Strategy, Investments, Leisure & Hospitality, Finance and GovernancePRIOR BUSINESS EXPERIENCE:–Hyatt Hotels Corporation, a global hospitality company managing and franchising luxury and business hotels, resorts and vacation properties:• Multiple leadership positions (2009-2016), including Senior Vice President & Interim CFO (2015-2016) and Senior Vice President, Strategy, FP&A, Investor Relations (2012-2016)Leadership, Strategy, Leisure & Hospitality, Franchising, Finance and Governance–Lowe Enterprises, a private real estate company managing more than $6 billion in assets.• Senior Vice President, Portfolio Management (2008-2009)Leadership, Strategy, Investment, Finance–Hilton Hotels Corporation, a global hospitality company managing and franchising a broad portfolio of hotels and resorts.•Multiple investor relations, finance and e-business positions (1998-2007)Strategy, Investment, Finance, E-Commerce, Leisure & Hospitality–Coopers & Lybrand, LLP (n/k/a PwC), a Big Eight public accounting firm.• Associate, Hospitality Consulting Practice (2008-2009)Investment, FinancePUBLIC COMPANY BOARDS:–Current: Dave & Buster’s Entertainment, Inc.OTHER POSITIONS/MEMBERSHIPS:– Director, Visit OrlandoEDUCATION:– B.S. with honors, Cornell University– M.M. Hospitality, Cornell University–M.B.A.-The Wharton School, University of PennsylvaniaDave & Buster’s Entertainment, Inc 10 Kevin M. Sheehan DIRECTOR SINCE: 2011AGE: 70COMMITTEES: FinanceDIRECTOR STATUS: IndependentCURRENT POSITIONS:–Chair of the Board of Dave & Buster’s Entertainment, Inc. since April 2021 (and also served as Interim CEO from October 2021 to June 2022).Leadership, Strategy, Board Governance, Finance, Operations, Food & Beverage,Amusements/Gaming, Marketing, Consumer Insights, Global–Chair and Principal Owner of Mellon Stud Ventures, a family investment company with wide range of businesses since 2016.Leadership, Strategy, Board Governance, Finance, Global, Investments, Hospitality, MarketingPRIOR BUSINESS EXPERIENCE:–Margaritaville at Sea, a cruise line owned by Mellon Stud Ventures since 2016.•Chair and Principal Owner from 2016 to October 2023Leadership, Strategy, Board Governance, Hospitality, Finance, Global, Consumer Insights, Marketing–Scientific Games Corporation, a global leader in the gaming and lottery industries•Senior Advisor from June 2018 to September 2018 and Director until October 2018•President and Chief Executive Officer from August 2016 to June 2018Leadership, Strategy, Board Governance, Gaming, Finance–Robert B. Willumstad School of Business, Adelphi University, a New York metropolitan area business school•John J. Phelan, Jr. Distinguished Visiting Professor of Business (February 2015-June 2016)•Distinguished Visiting Professor-Accounting, Finance and Economics (2005-2008)Strategy, Finance, Accounting–NCL Corporation, Ltd, a leading global cruise line operator:•Chief Executive Officer (November 2008-January 2015)•President (August 2010-January 2015; August 2008-March 2009)•Chief Financial Officer (2007-2010)Leadership, Strategy, Food & Beverage, Hospitality, Finance, Global, Consumer Insights, Marketing–Cerberus Capital Management LP (2006-2007), a global leader in private equity investments:•ConsultantFinance, Private Equity, Strategic–Clayton Dubilier & Rice (2005-2006), one of the oldest private equity investment firms in the world:•ConsultantFinance, Private Equity, Strategic–Cendant Corporation, a global business and consumer services provider:•Various executive roles, including, Chair and Chief Executive Officer of the Vehicle Services Division (including global responsibility for Avis Rent A Car, Budget Rent A Car, Budget Truck PHH Fleet Management and Wright Express) (1996-2005)Leadership, Strategy, Finance, Global, Consumer Insights, MarketingPUBLIC COMPANY BOARDS:– Current: Dave & Buster’s Entertainment, Inc.Gannett Co., Inc. (Lead Director) – Past 5 years: Scientific Games Corporation (2016-2018); Navistar International Corporation (2018-2021); Hertz Global Holdings (2018-2021)OTHER POSITIONS/MEMBERSHIPS:–Certified Public AccountantEDUCATION:–B.S. Hunter College–M.B.A. New York University Graduate School of BusinessACCOLADES:–Named “Miami Ultimate CEO” by South Florida Business Journal (2011)– Ernst & Young Entrepreneur of the Year (2014 – Florida Region)Dave & Buster’s Entertainment, Inc 11 Jennifer Storms DIRECTOR SINCE: 2016AGE: 52COMMITTEES: Compensation and Nominating andCorporate GovernanceDIRECTOR STATUS: INDEPENDENTCURRENT POSITION:–Chief Marketing Officer, Entertainment and Sports for NBCUniversal, a leading global media and entertainment company developing, producing, and marketing of entertainment, news and information, since September 2020 (previously served as Chief Marketing Officer and Executive Vice President Content Strategy from March 2019-September 2020 and Chief Marketing Officer, NBC Sports Group a division of NBCUniversal from October 2015-March 2019).Leadership, Strategy, Marketing, Consumer Insights, Global, EntertainmentPRIOR BUSINESS EXPERIENCE:–PepsiCo, Inc.:•Senior Vice President of Global Sports Marketing (2011-2015)Leadership, Strategy, Marketing, Consumer Insights, Global, Food & Beverage–The Gatorade Company, Inc. (a subsidiary of PepsiCo, Inc.), a manufacturer of sports-themed beverages and food products:•Senior Vice President of Sports Marketing (2009-2011)Leadership, Strategy, Marketing, Consumer Insights, Food & Beverage–Turner Broadcasting System/Turner Sports, a division of the American media conglomerate providing sports programing on television and digital media:•Multiple marketing and leadership positions, including, Senior Vice President, Sports Programming and Marketing (1995-2009)Leadership, Strategy, Marketing, Consumer InsightsPUBLIC COMPANY BOARDS:–Current: Dave & Buster’s Entertainment, Inc.OTHER POSITIONS/MEMBERSHIPS:–Member, KPMG Women’s Leadership Summit Advisory CouncilEDUCATION:–B.A. Northwestern UniversityACCOLADES:– Named Cynopsis Sports Media’s Marketing Executive (2018)–Named to iSportsConnect’s Influential Women in the business of Sport list (2018)–Member, Forty Under 40 Hall of Fame, SportsBusiness Daily/Global/Journal (2009)The Board of Directors recommends a vote FOR the election of each of the nominated directors.Dave & Buster’s Entertainment, Inc 12 PROPOSAL NO. 2RATIFICATION OF APPOINTMENT OF INDEPENDENTREGISTERED PUBLIC ACCOUNTING FIRMThe Audit Committee of the Board of Directors has selected KPMG LLP (“KPMG”), to be the Company’s independent registered public accounting firm to conduct the audit of our consolidated financial statements and the effectiveness of our internal controls over financial reporting for the fiscal year ending January 29, 2017,2024 and recommends that the stockholdersshareholders vote for ratification for suchthis appointment. KPMG has been engaged as our independent registered public accounting firm since 2010.2010 and the Audit Committee and the Board believe that the continued retention of KPMG as the Company’s independent registered public accounting firm for the 2024 fiscal year is in the best interests of the Company and its shareholders. As a matter of good corporate governance, the Audit Committee has requested the Board of Directors to submit the selection of KPMG as the Company’s independent registered public accounting firm for the 2016 fiscal year2024 to stockholdersshareholders for ratification. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection.selection but may still decide to retain KPMG. Even if the selection of KPMG is ratified by the shareholders, the Audit Committee has the discretion to select another auditor at any time if it determines that a change would be in the best interests of the Company or its shareholders. We expect representatives of KPMG to be present at the Annual Meeting. They will have the opportunity to make a statement at the Annual Meeting if they desire to do so and will be available to respond to appropriate questions.Audit and Related FeesAudit and Related Fees The following table sets forth the fees (dollars shown are in thousands) for professional audit services and fees for other services provided to the Company by KPMG, for the 2014 fiscal year2023 which ended on February 1, 20154, 2024 and the 2015 fiscal year2022 which ended on January 31, 2016: 2015 2014 Audit Fee(1) $948 $620 Audit-Related Fees(2) - $24 Tax Fees - - Total $948 $644 Fiscal 2023 Fiscal 2022 Audit Fee (1) $ 1,155 $ 1,470 Audit-Related Fees (2) 400 — Tax Fees (3) 30 — Total $ 1,585 $ 1,470 (1)Includes fees for services for the audit of the Company’s annual financial statements, the reviews of the interim financial statements, audit of the Company’s internal control over financial reporting, (fiscal year 2015 only), implementation of accounting pronouncements,and assistance with SEC filings,Securities and feesExchange Commission filings. Fiscal 2022 also included the audit of purchase price accounting related to the initial public offering and subsequent follow-on offeringsCompany's acquisition of our Common Stock.(2)Includes fees relatedreal time assessment of the ERP system the Company intends to certain capital market transactions.(3)Includes transfer pricing study.The Audit Committee has established a policy whereby the outside auditors are required to annually provide service-specific fee estimates and seek pre-approval of all audit, audit-related, tax and other services prior to the performance of any such services. Individual engagements anticipated to exceed the pre-approved thresholds must be separately approved by the Audit Committee. For both fiscal 20152023 and 2014,2022, the Audit Committee pre-approved 100% of all audit, audit-related services and tax services were pre-approvedprovided by the Audit Committee, whichKPMG and concluded that the provision of such services by KPMG was compatible with such firm’s independence.The Board of Directors recommends a vote FOR the ratification of the appointment of KPMG LLP. Dave & Buster’s Entertainment, Inc 13 PROPOSAL NO. 3TO AMEND OUR SECOND AMENDED AND RESTATEDCERTIFICATE OF INCORPORATION TO ALLOW REMOVAL OFDIRECTORS WITH OR WITHOUT CAUSE BY VOTE OF AMAJORITY OF STOCKHOLDERSOur Board has recommended and is seeking stockholder approval of an amendment to our Second Amended and Restated Certificate of Incorporation to provide that any director of the Company may be removed, with or without cause, upon the affirmative vote of the holders of a majority of the shares of the Company’s stock then entitled to vote at an election of directors.Article V, Section (D) of our Second Amended and Restated Certificate of Incorporation currently provides that any director may be removed, but only with cause, by the affirmative vote of a majority of the remaining members of the Board or the holders of at least sixty-six and two-thirds percent (662/3%) of the then outstanding voting stock of the Corporation then entitled to vote on the election of directors, voting together as a single class.On December 21, 2015, the Delaware Chancery Court issued an opinion inIn re Vaalco Energy, Inc. Stockholder Litigation, Consol. C.A. No. 11775-VCL, invalidating as a matter of law provisions of the certificate of incorporation and bylaws of VAALCO Energy, Inc., a Delaware corporation, which permitted the removal of VAALCO’s directors by its stockholders only for cause. The Chancery Court held that, in the absence of a classified board or cumulative voting in the election of directors, VAALCO’s “only for cause” director removal provisions conflict with Section 141(k) of the Delaware General Corporation Law and are therefore invalid and unenforceable. In light of the Chancery Court’s holding, and because we do not have a classified board or cumulative voting in the election of directors, the Board has approved, and recommends for approval by the stockholders, amending Article V, Section (D) to remove the provisions regarding the removal of directors for cause only, the accompanying supermajority (662/3%) voting threshold, and the accompanying definition of “cause.” These changes are intended to conform the Company’s certificate of incorporation to the requirements of Delaware Law as applicable to the Company, and are reflected in Appendix A. The amended text will read as follows:(D)Removal. Any director or the entire Board may be removed, with or without cause, by the holders of a majority of the shares then entitled to vote at an election of directors.If the amendment is approved, the Company intends to promptly file a Third Amended and Restated Certificate of Incorporation with the Secretary of State of Delaware, which includes the amendment contemplated by this proposal but does not further amend the Second Amended and Restated Certificate of Incorporation. The affirmative vote of at least sixty-six and two-thirds percent (662/3%) of the outstanding voting stock of the Company will be required for approval of this proposal.The Board of Directors recommends a vote FOR the amendment of our Second Amended and Restated Certificate of Incorporation to allow removal of directors with or without cause by a vote of a majority of Stockholders.

ADVISORY VOTE ON EXECUTIVE COMPENSATION

This resolution

| The Board of Directors recommends an advisory vote FOR the approval of our executive compensation. | ||

| Dave & Buster’s Entertainment, Inc | 14 | ||||

ADVISORY VOTE ON FREQUENCY OF

VOTES ON EXECUTIVE COMPENSATION

As required by SEC rules, we are asking you to vote on an advisory, non-binding basis, on how frequently we should present to you the advisory vote on executive compensation. SEC rules require the Company to submit to a stockholder vote at least once every six years whether advisory votes on executive compensation should be presented every one, two or three years.

After careful consideration of the frequency alternatives, the Board believes that a one year frequency for conducting an advisory vote on executive compensation is appropriate for the Company and its stockholders at this time. Notwithstanding the outcome of this vote, stockholders, at their discretion at any time, may communicate directly with the Board of Directors on various issues, including executive compensation.

Stockholders must specify one of four choices for this proposal on the proxy card: one year, two years, three years or abstain. While this vote is advisory and non-binding on the Company, the Board of Directors and the Compensation Committee will carefully consider the outcome of the vote, among other factors, when making future decisions regarding the frequency of advisory votes on executive compensation. Because this vote is advisory in nature, it will not affect any compensation already paid or awarded to any named executive officer and will not be binding on or overrule any decisions by the Board of Directors, and will not restrict or limit the ability of the stockholders to make proposals for inclusion in proxy materials related to executive compensation.

The Board of Directors recommends an advisory vote of ONE YEAR on the frequency of votes on our executive compensation.

DIRECTORS AND CORPORATE GOVERNANCE

Composition and Board Independence

| Composition and Board Independence | ||

Corporate Governance

Act, and that each member of the Compensation Committee, Messers. Chambers and Griffith, and Ms. Storms, satisfies the independence requirements for members of a compensation committee under the applicable rules of NASDAQ.

| Corporate Governance | ||

corporate-governance

.has engaged FW Cook as its independent compensation consultant.

chair for each committee of the Board of Directors, reviews and recommends to the Board matters regarding CEO succession plans, provides oversight concerning the Company’s corporate responsibility and sustainability efforts, periodically reviews and assesses our Corporate Governance Guidelines and Principles and Code of Business Conduct and Ethics and oversees the annual self-evaluation of the performance of the Board of Directors and the annual evaluation of the performance of our management. The Nominating and Corporate Governance Committee operates pursuant to a charter that was adopted in October 2014. The Oak Hill Funds have the right to nominate the members of the Nominating and Corporate Governance Committee, up to a number of nominees not to exceed the number of directors designated by the Oak Hill Funds on the Board of Directors, and the remaining members will be nominated by the Board of Directors. The Nominating and Corporate Governance Committee did not meet in 2015.

In February 2016, we established aheld five meetings during fiscal 2023.

| Dave & Buster’s Entertainment, Inc | 15 | ||||

fiscal 2023.

| The Board’s Role in Risk Oversight | ||

The Audit Committee also has oversight of the Company’s cyber, information security and technology matters and is provided regular comprehensive updates by Company management on the Company’s information security status, including the results of annual SOX and Payment Card Industry Data Security Standard audits; our leveraging of recognized frameworks and standards, including the National Institute of Standards and Technology Cyber Security Framework, Center for Internet Security Critical Security Controls and the Payment Card Industry Data Security Standards; independent third party assessments of our cyber environment; and our annual team member awareness training. During fiscal 2023, the business strategy, results of operations and financial condition of the Company have not been materially affected by risks from cybersecurity threats.

| Succession Planning | ||

| Board of Directors Leadership Structure | ||

| Director Compensation | ||

| Dave & Buster’s Entertainment, Inc | 16 | ||||

Director Compensation

annual equity grant value starting in fiscal 2024.

| DIRECTOR COMPENSATION TABLE | |||||||||||||||||

| NAME(1) | FEES EARNED ($)(2) | STOCK UNIT AWARDS ($)(3) | TOTAL ($) | ||||||||||||||

| James P. Chambers | $ | 105,000 | $ | 128,061 | $ | 233,061 | |||||||||||

| Hamish A. Dodds | $ | 105,000 | $ | 128,061 | $ | 233,061 | |||||||||||

| Michael J. Griffith | $ | 90,000 | $ | 128,061 | $ | 218,061 | |||||||||||

| Gail Mandel | $ | 95,000 | $ | 128,061 | $ | 223,061 | |||||||||||

| Atish Shah | $ | 110,000 | $ | 128,061 | $ | 238,061 | |||||||||||

| Kevin M. Sheehan | $ | 210,000 | $ | 128,061 | $ | 338,061 | |||||||||||

| Jennifer Storms | $ | 105,000 | $ | 128,061 | $ | 233,061 | |||||||||||

| NAME (1) | FEES ($) (2) | STOCK ($) (3) | OPTION AWARDS ($) (4)(5) | TOTAL ($) | ||||||

Michael J. Griffith | 57,500 | 57,490 | 57,493 | 172,483 | ||||||

Jonathan S. Halkyard | 57,500 | 57,490 | 57,493 | 172,483 | ||||||

David A. Jones | 70,000 | 57,490 | 57,493 | 184,983 | ||||||

Alan J. Lacy | 85,000 | 57,490 | 57,493 | 199,983 | ||||||

Patricia H. Mueller | 45,337 | 57,482 | 57,496 | 160,315 | ||||||

Kevin M. Sheehan | 75,000 | 57,490 | 57,493 | 189,983 | ||||||

(3)The amounts shown in this column represent the aggregate grant date fair values of the restricted stock units awarded on April 24, 2023. The amounts were calculated based on the closing share price on the day preceding the grant. However, the number of underlying shares were calculated on date of grant approval. Each restricted stock unit vests one year after the award date. As of February 4, 2024, the aggregate number of shares of Company common stock underlying outstanding non-vested restricted stock units for each non-employee director was 3,739; as noted in the Directors Outstanding Equity Awards at 2023 Fiscal Year End table of this Proxy Statement, Mr. Sheehan also has 30,098 outstanding non-vested restricted stock units that he received for his service as Interim CEO of the Company. Pursuant to the Director Deferred Compensation Plan, each non-employee director has the option to defer the distribution of all or a portion of his or her restricted stock unit award. Units deferred will be distributed upon death or disability of the director or over a period not to exceed five years, as elected by the director, following the date he or she leaves the Board of Directors. Messrs. Chambers, Griffith and Sheehan and Ms. Mandel deferred 100% of their 2023 restricted stock unit awards.

Directors Outstanding Equity Awards at 2023 Fiscal Year End

(1)Messrs. Chambers, Dodds and Shah and Ms. Mandel do not hold any stock options. (2)Mr. Sheehan holds 30,098 unvested restricted stock units granted to him on April 18, 2022 while serving as Interim CEO for the Company in fiscal 2022. In addition to reimbursement for out-of-pocket expenses incurred in connection with their Board service, Fiscal 2023 Annual Director Compensation

(1)Actual # of (2)Lead Independent Director Fee is paid to the independent Chair of All cash fees are paid in quarterly installments, and the equity grant is made in the first quarter of each fiscal year. The Compensation

The Company has a stock ownership requirement for non-employee directors to align the interests of its non- employee directors with the interests of the shareholders and to further promote the Company’s commitment to sound corporate governance. Under this requirement, a non-employee director must own shares of the Company’s stock with a fair market value equal to five (5) times the director’s annual cash retainer. Each non-employee director has five (5) years from the date of initial appointment or election to the Board to meet this requirement. If at time of measurement, a director is not in compliance with this guideline, the director is prohibited from selling 50% of any new equity award issued to them (net of taxes) until such time as they come into compliance.

Mr. Morris, as an employee director, is governed by the stock ownership guidelines for executive officers. These guidelines are detailed under Stock Ownership Guidelineselsewhere in the

this Proxy Statement .

The Company identifies new director candidates through a variety of sources. The Nominating and Corporate Governance Committee will consider director candidates recommended by

Shareholders may also propose director nominees by adhering to the advance notice procedure described under

The Nominating and Corporate Governance Committee and the Board believe that candidates for director should have certain minimum qualifications, including, without limitation: •demonstrated business acumen and leadership, and high levels of accomplishment; •ability to exercise sound business judgment and to provide insight and practical wisdom based on experience; •commitment to understand the Company and its business, industry and strategic objectives; •integrity and adherence to high personal ethics and values, consistent with our Code of Business Conduct and Ethics; •ability to read and understand financial statements and other financial information pertaining to the Company; •commitment to enhancing shareholder value; and •willingness to act in the long-term interest of all shareholders. In the context of the Board’s existing composition, other requirements (such as prior CEO experience, restaurant, hospitality, gaming, sports-related marketing and branding, or retail industry experience, or relevant senior level experience in finance, accounting, sales and marketing, organizational development, information technology, or public relations) that are expected to contribute to the Board’s overall effectiveness and meet the needs of the Board and its committees may be considered. The Company values diversity

The Nominating and Corporate Governance Committee conducted an evaluation and assessment of

The Code of Business Conduct and Ethics applies to our directors, officers and other employees and is available on our website at http://ir.daveandbusters.com/

corporate-governance .

During Storms. None of our executive officers serve on the compensation committee or board of directors of any other company of which any of the members of our Compensation Committee or any of our directors is an executive officer.

If

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT The following table shows the ownership of our common stock by (a) all persons known by us to beneficially own more than 5% of our common stock, (b) each present director, (c) the named executive officers, and (d) all executive officers and directors as a group. We have determined beneficial ownership in accordance with the rules of the SEC, and unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares that they beneficially own, subject to community property laws where applicable. We have based our calculation of the percentage of beneficial ownership on

Named Executive Officers(13) Dolf Berle (14) Brian A. Jenkins(15) John B. Mulleady (16) Jay L. Tobin (17) All Executive Officers and Directors as a Group (21 Persons)(18)

*Less than 1%.

(1)Based on information contained in Schedule 13D/A dated December 5, 2023, filed on December 7, 2023 The Schedule 13D/A reported that Hill Path Capital Partners LP (“HPCP”), Hill Path Capital Partners II LP (“HCCP-II”), Hill Path Capital Co-Investment Partners LP (“HPCCP”), Hill Path D Fund LP, Hill Path G Fund LP, Hill Path J Fund LP, Hill Path Capital Partners GP LLC, Hill Path Capital Partners II GP LLC, Hill Path Investment Holdings LLC, Hill Path Investment Holdings II LLC, Hill Path Capital LP, Hill Path Holdings LLC, HP D GP LLC, HP G GP LLC, HP J GP LLC, and Scott I. Ross are collectively the “HP Reporting Persons” thereunder. The HP Reporting Persons owned and had sole voting and dispositive power over 7,119,255 shares of common stock, including 2,095,246 shares of common stock held directly by HPCP, 2,869,527 shares of common stock held directly by HPCP-II, and 53,231 shares of common stock held by HPCCP, and no shared voting or dispositive power over shares of common stock. (2)Based on information contained in Schedule 13G/A dated December 31, 2023, filed on January 23, 2024. The Schedule 13G/A reported that BlackRock, Inc. owned and had sole dispositive power over 5,332,323 shares of common stock and had sole voting power over 5,288,113 shares of common stock. (3)Based on information contained in Schedule 13G/A dated December 29, 2023, filed on February 13, 2024. The Schedule 13G/ A reported that The Vanguard Group owned and had sole dispositive power over 4,311,693 shares of common stock, sole voting power over no shares of common stock, shared voting power over 66,246 shares of common stock and shared dispositive power over 100,855 shares of common stock. (4)Based on information contained in Schedule 13G dated December 31, 2023, filed on February 14, 2024. The Schedule 13G reported that Eminence Capital, LP, owned and had shared dispositive power over 3,191,559 and shared voting power over 3,191,559 shares of common stock. (5)Shares reflected in the table include 33,546 shares owned by Mr. Griffith and 17,948 shares owned by The 2014 Griffith Family Trust dated October 20, 2014 (the “Family Trust”). Currently, Mr. Griffith has sole voting and investment power over all of the shares owned by the Family Trust. Shares reflected in the table also include 9,748 shares issuable pursuant to outstanding stock options held by Mr. Griffith, all of which are fully vested. (6)Shares reflected in the table include 37,671 shares issuable pursuant to outstanding stock options held by Mr. Morris that are exercisable within 60 days of April 3, 2024. (7)Shares reflected in the table include 127,278 shares owned by Mr. Sheehan but do not include 100,000 shares owned by a family limited liability company (the "Family LLC"). Currently, Mr. Sheehan has no sole or shared voting and investment power in any of the shares in the Family LLC as an irrevocable trust is the managing member of the Family LLC. Shares reflected in the table also include 9,748 shares issuable pursuant to outstanding stock options held by Mr. Sheehan, all of which are fully vested. (8)Shares reflected in the table include 4,224 shares issuable pursuant to outstanding stock options held by Ms. Storms, all of which are fully vested. (9)In addition to Mr. Morris who also serves as a director. (10)Shares reflected in the table include 63,056 shares issuable pursuant to outstanding stock options held by Mr. Mulleady that are exercisable within 60 days of April 3, 2024. (11)Shares reflected in the table include 9,165 shares issuable pursuant to outstanding stock options held by Mr. Quartieri that are exercisable within 60 days of April 3, 2024. (12)Ms. Tobin does not have any shares issuable pursuant to outstanding stock options held by her that are exercisable within 60 days of April 3, 2024. (13)Shares reflected in the table include 6,396 shares issuable pursuant to outstanding stock options held by Mr. Wehner that are exercisable within 60 days of April 3, 2024. (14)Shares reflected in the table include a total of 160,119 shares issuable pursuant to outstanding stock options held by our Executive Officers and Directors as a group that are exercisable within 60 days of April 3, 2024.

EXECUTIVE OFFICERS

We are furnishing below certain biographical information

EXECUTIVE COMPENSATION

This section describes our compensation program for our named executive officers (“NEOs”) for fiscal were: •Chris Morris - Chief Executive Officer •Michael Quartieri – Chief Financial Officer(1) •John B. Mulleady – Chief Development Officer •Megan Tobin - Chief Marketing Officer •Tony Wehner – Chief Operating Officer (1) Mr. Quartieri will retire as Chief Financial Officer on June 16, 2024. Business, Strategy and Performance Highlights for Fiscal 2023 Please see the highlights for fiscal 2023 set forth on pages 4-5 of the Summary section of this Proxy Statement. Compensation Executive Compensation Programs Our executive compensation philosophy is based upon three core values:pay for performance, market-competitive pay and sustained Pay for Performance—This creation. Market-Competitive Pay—

company, business unit, and individual performance; scope of responsibility; critical needs and skill sets; experience; leadership potential; and succession planning. Consistent with our pay for performance core

values, compensation above

Sustained

are stock options, time-based restricted stock units and performance-based stock units. The Compensation Committee determines annually the appropriate use and weighting of each vehicle. Through this combination of vehicles and the design of our programs, we Our compensation philosophy guides us in our annual review of compensation and the assessment of the right pay for performance In sum, this philosophy

Compensation Practices The following list summarizes executive compensation practices that we have

Shareholder Say-on-Pay Vote for 2023 and Compensation Actions Taken Our investors were supportive of these pay actions as evidenced by the 91% vote in support of our Say-on-Pay resolution. The positive result of these votes is one of the many factors our Compensation Committee considers in evaluating our executive compensation program. Procedures for Determining Compensation Our Compensation Committee has the overall responsibility for designing and evaluating the salaries, incentive plan compensation, policies and programs for our executive officers, including the NEOs. The Compensation Committee relies on input from an independent compensation consultant and the experience of members of the Compensation Committee to guide our compensation decisions, including compensation of our NEOs. In addition, the Compensation Committee relies on input from our Chief Executive Officer regarding an executive officer’s individual performance (other than himself) and an analysis of our corporate performance. By a delegation of authority from the Board of Directors, the Compensation Committee has final authority regarding the overall compensation structure for the executive officers, including the NEOs. The compensation of our executive officers typically consists primarily of four major components: •base salary; •annual incentive awards; •long-term incentive awards; and •other benefits. Each of these components is discussed in detail in When making compensation decisions, the Compensation Committee considers, among other things: •the Company’s short- and long-term performance relative to financial and strategic targets; •the executive officer’s prior experience and sustained individual performance; •the significance of the executive officer’s contributions to the ongoing success of the Company;

•the scope of the executive officer’s responsibilities; •the future value the executive officer is expected to bring to the Company; and •the results of benchmarking studies, which illustrate value of the executive officer’s total compensation package relative to others in the industries with which we compete for talent. Annually, the Compensation Committee

FW Cook had no other direct business relationship with the Company

Committee. Pay for Performance Alignment

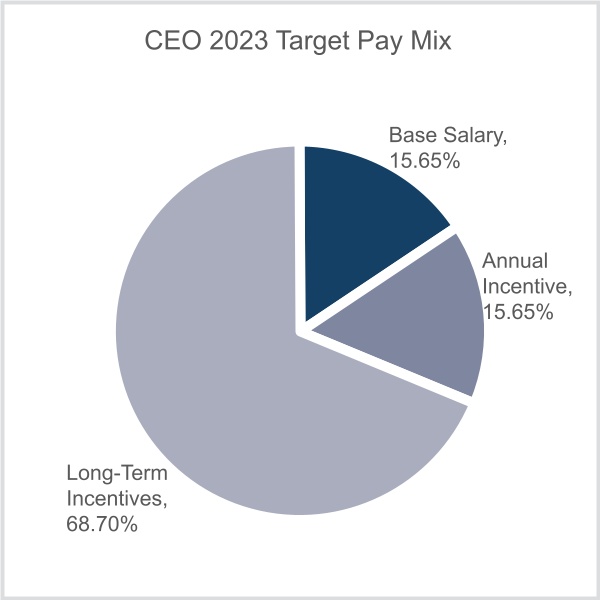

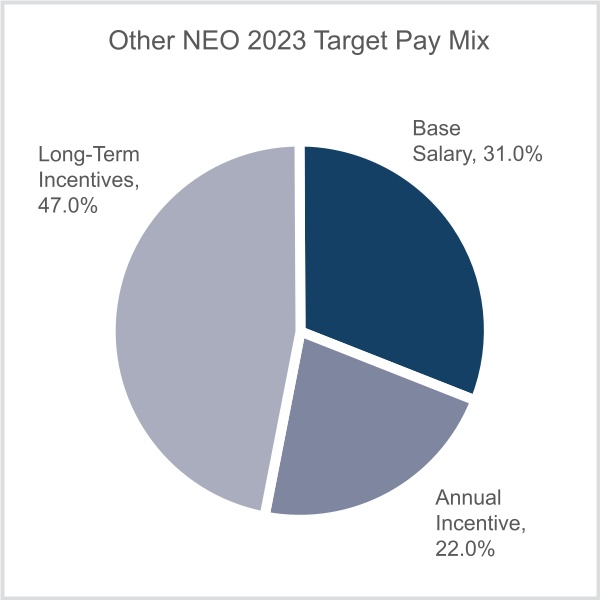

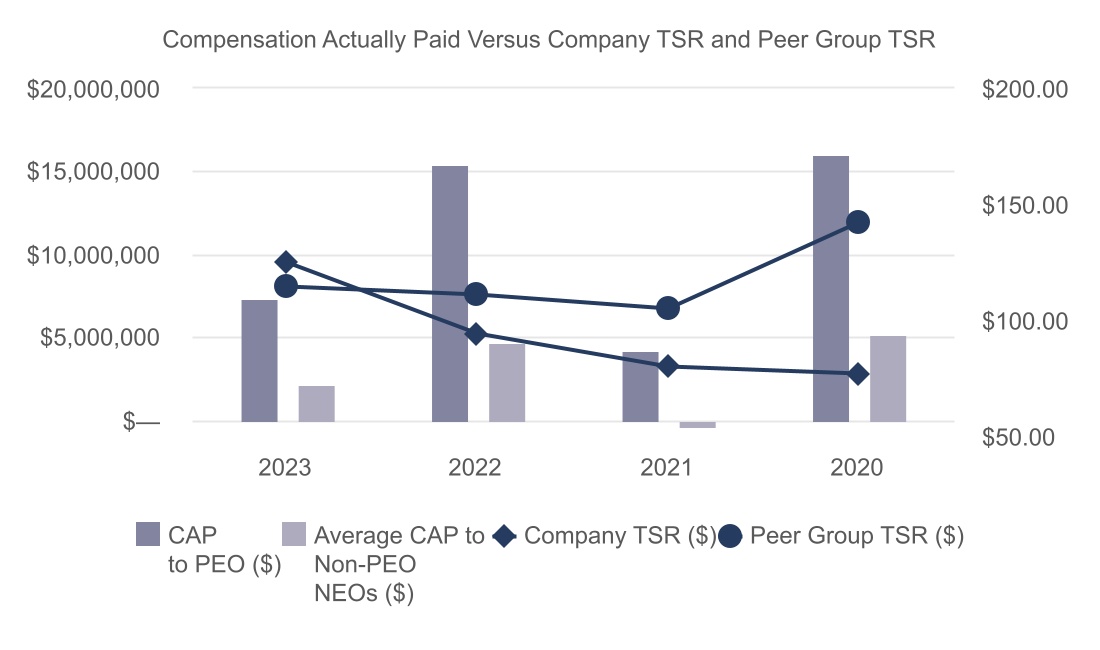

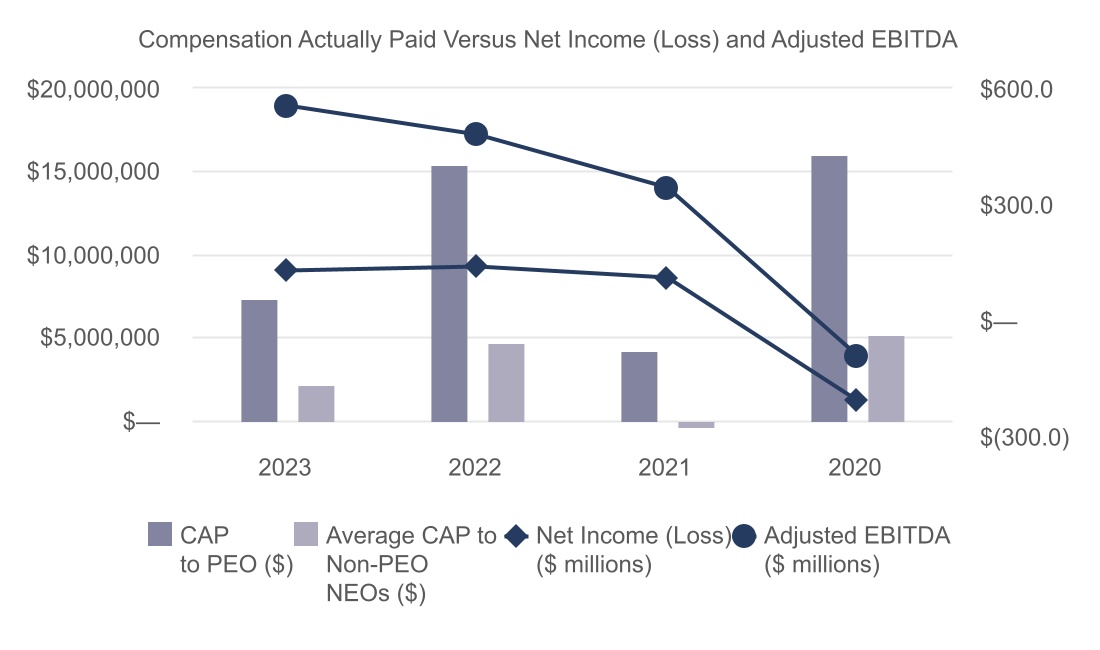

Typically, we work to leverage our executive compensation structure In evaluating whether the compensation programs appropriately link each executive officer’s compensation to Our fiscal 2023 compensation packages for our CEO and other NEOs were heavily weighted towards variable compensation. In doing so, we continued our focus on compensation for our CEO and NEOs tied to variable, long-term compensation and strengthening the alignment between compensation and our shareholder's long-term interests. Long-term incentives constituted the largest portion of the target total direct compensation

Elements of Compensation Base Salary A portion of each executive officer’s total compensation is in the form of base salary. This is a fixed cash

Company's Chief Operating Officer.

Annual Incentive Awards The Executive Incentive Plan created under the 2014

In considering and approving the annual plan design, the Compensation Committee reviews target bonus percentages for each executive officer, including the NEOs, and considers the value of the incentive award relative to the individual’s total compensation package, the value of the incentive award and total compensation package relative to that will comprise the components of the Executive Incentive Plan, the target for each component, and the payout percentages at threshold, target, and maximum performance for each component. The Compensation Committee

Under each executive officer’s employment agreement

Under the Executive Incentive

Company’s performance relative to targeted Total Revenue; and (iii) 25% of each executive officer's bonus opportunity was based on the Company's performance relative to targeted Same Store Sales Growth.

(1)Dollar amounts are represented in millions. At the close of the performance period, the Compensation Committee determined

(1) Ms. Tobin's target bonus is prorated for the portion of Fiscal 2023 she has been with the Company. Her full year target bonus would be $225,000. Long-term Incentive Awards The Compensation Committee believes that it is essential to align the interests of the executive officers, including the NEOs, and other key management personnel responsible for our growth with the interests of our Annually, the Compensation Committee determines whether to grant long-term cash- and/or stock-based incentives to executive officers, including the NEOs, and other key management personnel. In determining whether to award grants, the Compensation Committee considers Company performance, individual performance, the significance of

(1) Dollar amounts are represented in millions Other Benefits Retirement Benefits. Our employees, including our NEOs, are eligible to participate in the Company's 401(k)

Other Benefits. The Company eliminated cash perquisite allowances to its NEOs in fiscal 2022. We do offer our NEOs below. Severance Benefits. We have entered into employment agreements with each of our NEOs. These agreements provide our NEOs with certain severance benefits in the event of involuntary termination or adverse job changes and are key to attracting and retaining key executives. See below. Deductibility of

We consider objectives such as attracting, retaining and motivating leaders when we design our executive compensation CEO Pay Ratio The Compensation Committee reviewed a comparison of our Chief Executive Officer’s annual total compensation median employee. Stock Ownership Guidelines for Officers Our stock ownership guidelines were established

Equity counted toward the ownership requirement includes stock ownership, If at time of measurement, a senior executive officer is not in compliance with this guideline, such officer is prohibited from selling 50% of any new equity award issued to them (net of taxes) until such time as they come into compliance. Clawback Policy

In October 2023, the A copy of our clawback policy is filed as Exhibit 97 with our Annual Report on Form 10K. Risk Assessment Disclosure Our Compensation Committee assessed the risk associated with our compensation practices and policies for employees, including a consideration of the balance between risk-taking incentives and risk-mitigating factors in our practices and policies. The assessment determined that any risks arising from our compensation practices and policies are not reasonably likely to have a material adverse effect on our business or financial condition.

The Compensation

2023 Summary Compensation Table The following table sets forth information concerning all compensation that we paid or accrued during fiscal

(1)The following salary deferrals were made under the SERP in fiscal 2023: Mr. Morris $58,005, and Mr. Wehner $23,843. (2)Amounts in this column includes the aggregate grant date fair value of performance RSUs and PSUs calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 ("ASC 718"). These amounts do not include any reduction in value for the possibility of forfeiture. The discussion of the assumptions used for purposes of valuation of RSUs in fiscal 2023 appears in Note 8: Stockholders’ Equity, Share-Based Compensation, to our consolidated financial statements included in our Annual Report on Form 10-K. The grant date fair value for PSUs is reported based upon the probable outcome of the performance conditions on the grant date in accordance with SEC rules. (3)No options were granted to our NEOs in fiscal 2021. Amounts in this column for fiscal 2023 and 2022 grants reflect the aggregate grant date fair value of options calculated in accordance with ASC 718. These amounts do not include any reduction in value for the possibility of forfeiture. (4)Amounts in this column for 2023 reflect that no annual incentive was earned for fiscal 2023 under the Executive Incentive Plan. Amounts in this column for 2022 reflect the annual incentive earned for fiscal 2022 under the Executive Incentive Plan. Amounts in this column for 2021 reflect the annual incentive earned for fiscal 2021 under the Executive Incentive Plan and no cash incentive was earned for the performance cash portion of the 2019 long-term Incentive award program awarded to Mr. Mulleady in 2019, the only NEO with Company in 2019. (5)The following table sets forth the components of “All Other Compensation” for fiscal 2023:

(a)Amounts include any cash perquisite allowances paid. (b)Amounts include Company contributions to the 401(k) and SERP that were based on the Company’s contributions to the 401(k) plan and SERP made during fiscal 2023. (6) The amount in the Stock Awards column reflects Ms. Tobin's receipt of a similar one-time 5-year long term and performance grants that the other NEOs received in fiscal 2022 (the "Officer 5-year Grant").

The following table shows the grants of plan-based awards to the named executive officers in fiscal

(1)The shares shown reflect an award of PSUs, RSUs and options, as applicable, in accordance with the 2023 long-term incentive program implemented pursuant to the 2014 Stock Incentive Plan (the "2023 LTIP"). The shares shown in the “Threshold” column reflect the minimum possible payout (representing 50% of target) under the Company’s PSU component of the 2023 LTIP. The minimum award level is 0% of target ("Target") if the Threshold is not met, and the maximum award is 200% of target (“Maximum”). Threshold is represented with the minimum possible payout. (2)The amounts in this row are prorated for the portion of fiscal 2023 Ms. Tobin has been with the Company. Her full year threshold, target, and maximum amounts would be $112,500, $225,000, and $450,000, respectively. (3)The shares shown reflect an award of PSUs, RSUs and options, as applicable, in accordance with the Officer 5-year Grant. The shares shown in the "Threshold" column reflect the minimum payment level under the Company's PSU component of the Officer 5-year Grant. The minimum award level is 0% of target ("Target") and the maximum award is 100% of target ("Maximum"). Threshold is represented with the minimum possible payout. (4)This stock option grant requires a purchase of a certain dollar amount of Company stock in order to retain all or a portion of the options. The window for Ms. Tobin to make an election to meet all or part of the stock purchase condition had not expired as of the end of the fiscal 2023.

(1)The market value is equal to number of shares underlying the units, multiplied by the closing market price of the Company’s common stock on Friday, February 2, 2024, the last trading day of the Company’s fiscal year (being $55.19). (2)The market value is equal to the number of shares underlying the units based on achieving certain performance goals, multiplied by the closing market price of the Company’s common stock on Friday, February 2, 2024, the last trading day of the Company’s 2023 fiscal year (being $55.19). (3)These options represent vested options granted under the 2014 Stock Incentive Plan. (4)These options represent unvested options granted under the 2014 Stock Incentive Plan. Vesting of these options are as noted below. a.These options vest in three equal installments on an annual basis commencing on 4/24/2024 b.These options vest in four equal installments on an annual basis commencing on the second anniversary of the grant date. c.These options vest in two equal installments on an annual basis commencing on 4/18/2024. d.These options vest in four equal installments on an annual basis commencing on 12/8/2024. e.These options vest in three equal installments on an annual basis commencing on 1/16/2025. f.These options vest in five equal installments on an annual basis commencing on 1/16/2025. g.These options vest in four equal installments on an annual basis commencing on 10/14/2024. (5)This grant represents unvested RSUs under the 2023 LTIP granted on 4/24/2023. These RSUs vest in three equal installments on 4/24/2024, 4/24/2025 and 4/24/2026. (6)This grant represents unvested RSUs under the 2022 long-term incentive program implemented pursuant to the 2014 Stock Incentive Plan (the "2022 LTIP") granted on 6/29/2022. These RSUs vest in two equal installments on 4/18/2024 and 4/18/2025. (7)This grant represents unvested RSUs under the CEO 5-year performance grant made on 6/29/2022. These RSUs vest in four equal installments on 6/29/2024, 6/29/2025, 6/29/2026, and 6/29/2027.

(8)This grant represents unvested RSUs under the Officer 5-year performance grant made on 10/7/2022. These RSUs vest in four equal installments on 10/7/2024, 10/7/2025, 10/7/2026, and 10/7/2027. (9)This grant represents unvested RSUs under the 2022 LTIP granted on 4/18/2022. These RSUs vest in two equal installments on 4/18/2024 and 4/18/2025. (10)This grant represents unvested RSUs granted to Mr. Quartieri in connection with his joining the Company. These RSUs vest on 1/18/2025. (11)This grant represents unvested RSUs under the 2021 long-term incentive program implemented pursuant to the 2014 Stock Incentive Plan (the “2021 LTIP”). These RSUs vest on 4/23/2024. (12)This grant represents the earned number of unvested PSUs under the 2021 LTIP. These PSUs vest in two equal installments on 4/23/2023 and 4/23/2024. (13)This grant represents unvested RSUs granted to Ms. Tobin in connection with her joining the Company. These RSUs vest on 1/16/2025. (14)This grant represents unvested RSUs under the Officer 5-year performance grant made on 1/16/2024. These RSUs vest in five equal installments on 1/16/2025, 1/16/2026, 1/16/2027, 1/16/2028, and 1/16/2029. (15)This grant represents the target number of unvested PSUs under the 2023 LTIP. These PSUs, if earned under the performance conditions, vest 100% on 4/24/2026. (16)This grant represents the target number of unvested PSUs under the 2022 LTIP. These PSUs, if earned under the performance conditions, vest 100% on 4/18/2025. (17)This grant represents the target number of unvested PSUs under the CEO 5-year performance grant made on 6/29/2022. These PSUs, if earned under the performance conditions (200% stock price), vest 100% on 6/29/2027. (18)This grant represents the target number of unvested PSUs under the CEO 5-year performance grant made on 6/29/2022. These PSUs, if earned under the performance conditions (300% stock price), vest 100% on 6/29/2027. (19)This grant represents the target number of unvested PSUs under the Officer 5-year performance grant made on 10/7/2022. These PSUs, if earned under the performance conditions (200% stock price), vest 100% on 10/7/2027. (20)This grant represents the target number of unvested PSUs under the Officer 5-year performance grant made on 10/7/2022. These PSUs, if earned under the performance conditions (300% stock price), vest 100% on 10/7/2027. (21)This grant represents the target number of unvested PSUs under the 2022 LTIP. These PSUs, if earned under the performance conditions, vest 100% on 4/18/2025. (22)This grant represents the target number of market stock units ("MSUs") under the 2021 LTIP. These MSUs, if earned under the performance conditions, vest 100% on 4/23/2024. (23)This grant represents the target number of unvested PSUs under the Officer 5-year performance grant made on 1/16/2024. These PSUs, if earned under the performance conditions (200% stock price), vest 100% on 1/16/2029. (24)This grant represents the target number of unvested PSUs under the Officer 5-year performance grant made on 1/16/2024. These PSUs, if earned under the performance conditions (300% stock price), vest 100% on 1/16/2029.

(1)The value realized on the exercise of options is equal to (i) the amount per share at

The SERP is

investment options similar in type to our 401(k) plan. The following table shows contributions to each NEO’s deferred compensation account in